Overview - Loan Management Solution

In today's transforming financial landscape, lenders are looking for modern, technologically superior loan management system that automates key processes. The need of the hour is for systems which are scalable, fast, flexible and agile, while being cost efficient. Nelito Systems has emerged as a leading global Loan Management Software provider due to its modular API-BASED methodology and highly customizable product, that can integrate with many systems and a superior credit rating process.

FinCraftTM Loan Management Solution (LMS) supports multiple facets of Loan portfolio starting from prospecting to closure and monitoring. The comprehensive loan management solution facilitates banks and financial institutions to automate the procedures for achieving cost savings and better customer experience. We deliver tech enabled lending processes that improve productivity and customer service through the entire loan lifecycle.

Nelito's Loan Management Solution helps Cost Reduction and Faster Loan Approval using Cutting Edge Technology.

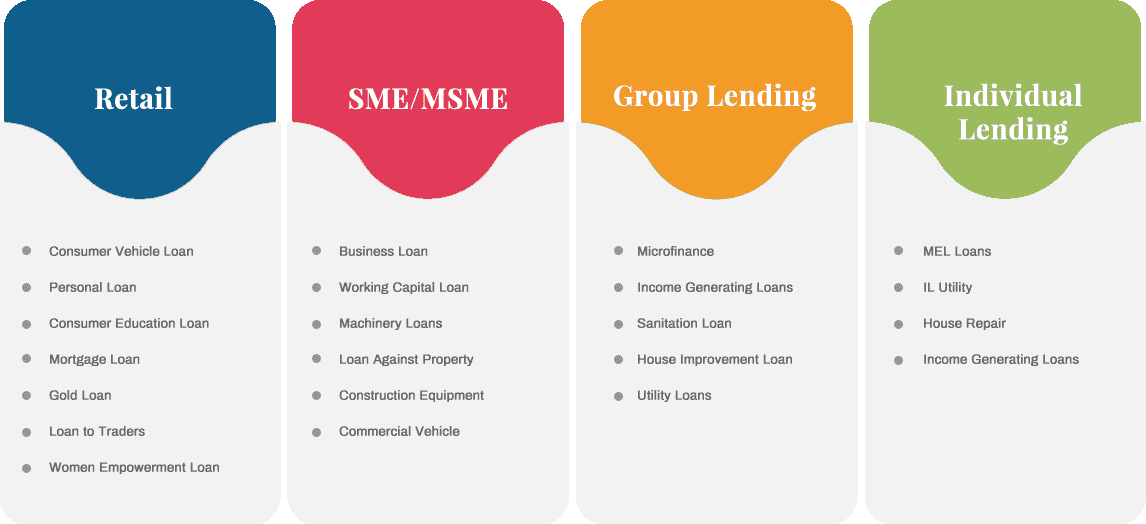

Nelito provides a robust Loan Product Suite for Agriculture Loans, Retail Loans, MSME loans and Project Finance etc. which delivers end-to-end Loan Management functionality for all types of loans & advances. Our Loan Management System offers Configurable Product rule engine consisting of Limit Frame Work, Collateral Setup, Recovery Appropriation Policy, Interest & Changes Structure etc.

The FinCraftTM LMS loan management system helps in quality improvement, improving turnaround time and better service for customers. It helps banks and financial institutions to improve the activity, transparency, competency and efficiency of their lending solutions.

Benefits

- Increase Customer reach through Omni-channel and DSA network

- Cost Reduction and Faster Loan Approval using Cutting Edge Technology/Services

- Reduces Credit Risk and NPA

- Secure and Scalable solution

- Deep Dive into Profitability analysis

- Compliance to Regulatory Reporting through comprehensive reporting module

- Enhanced operations and service levels with optimal cost

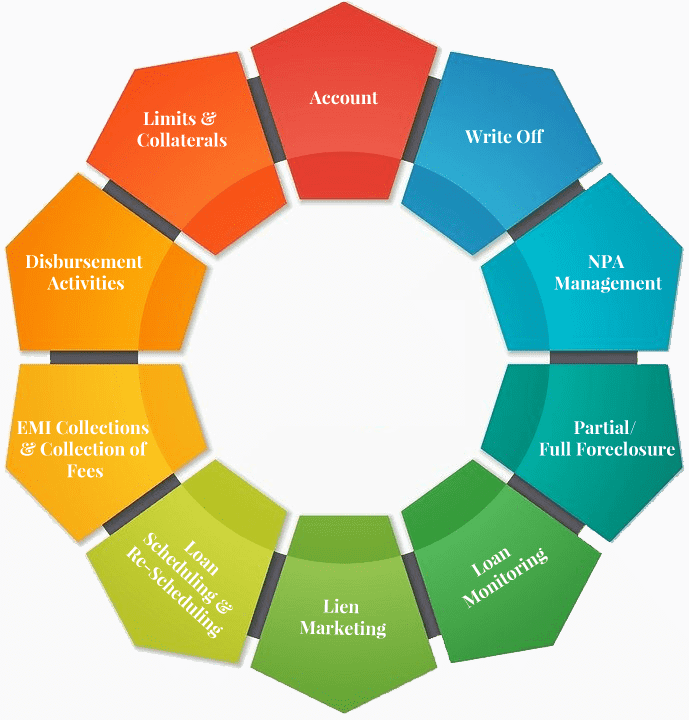

Key Activities of Loan Management Solution

The FinCraftTM Loan Management Solution comprises of prebuilt activities starting from Loan document execution, Loan Account creation and Loan Disbursement, Funded and Non Funded Limit management, Collateral Management, Repayment Schedule, Collection work flow, Balancing and Overdue, Interest and Charges Application, Account settlement, NPA Management, write off to Rephasement and reschedule activity.

Line of Business Covered

Testimonials

-

The project headed by Mr. Prashant Hedge & team have put their good efforts in Implementing new ASP software successfully which is as per our satisfaction.

Maheshwari ( IT Head )Vikramaditya Nagrik Sahakari Bank Ltd

-

We have successfully made Nelito's Fincraft Software for NBFC live in early March for LOS,LMS and Sanjiv Khalkho, Arijit Chakraborty with his team have been very instrumental in making this software live . I would like to appreciate on the turnaround time during the go live phase of the team in getting some of our key requirements done and helping our users to use the software for recording and disbursing all the sales from the software.In technology side I would like to praise Pramod Navale and Ganesh Khetmalis for in depth knowledge of the product and their technical skills is outstanding. Looking forward for the continued relationship for our next release and whole of 2018.

Prateek P Katyal ( CTO )WheelsEMI Pvt. Ltd

-

Our bank is using Fincraft, CBS of Nelito system since 2011. The application is functionally rich & user friendly and easy to navigate. The convenience of integrating other supporting applications of Nelito CTS, NEFT, RTGS, HO Module (share), Loan Origination, Internet Banking etc. helped us in smooth automation of various banking operations. We are very much thankful for providing such a good technology of coop banking sector and hope better performance in coming days. Wish You All the Best.

Gunvantbhai Shah (Vice Chairman)Mahudha Nagrik Sahakari Bank

-

"Nelito has Good knowledge of industry. Good customer orientation. They were Flexible and Open to new ideas and suggestions."

Mr. Ratheesh K. BharathanExec. Vice President & Co- Founder

-

"The best mix of functionality and technological support and our vision of "Cash Less and Paper Less" work environment for Sonata has come true with our technological partner Nelito. I highly recommend FinCraft Core Microfinance platform and especially integrations with a number of third party services."

IT HeadSonata Finance Pvt. Ltd.

-

Overall we are happy with the services provided by Nelito. The implementation team is sensitive to our support requirements and does a good job.

Vinayak Khadye (Chief Digital Officer)Finanzmart Services Pvt Ltd

-

For a Bank of our size, this system suffices and is very cost effective. Almost all of the bank's activities run on the one system. Nelito constitutes a partner more than a supplier and the relationship includes provision of the bank's underlying technology as well as its Fincraft range of applications.

ChairmanThe Nainital Bank Ltd.

Happy Clients

News

-

![economic times]()

March 2019 - Nelito welcomes their new client – Alliance for Microfinance in Myanmar!

-

Nelito got featured in India's leading publication - The Economic Times

Agility is very important as it sets the banks apart. Banks function slower as compared to the NBFCs, which is why agility is important.

-

NELITO FEATURES IN IBS'S ANNUAL SALES LEAGUE TABLE 2017 (LENDING)

Nelito's award winning FinCraftTM Integrated Lending Management Solution has been included in IBS's Annual Sales...

-

![solutions for bfs market]()

Solutions For The BFS Market The afternoon

-

![PTI News]()

Nelito Systems Receives Global Accolades for Innovation in Lending Management Software Press Trust of India