ADF/CIMS Regulatory Reporting Solution

The objective of Automated Data Flow (ADF)/Centralised Information and Management System (CIMS) is to ensure the submission of accurate and consistent data in prescribed format from the banks right from their core systems to RBI without any human intervention.

As per the ADF guidelines, banks are expected to ensure that the process of handling information is flexible and mature.

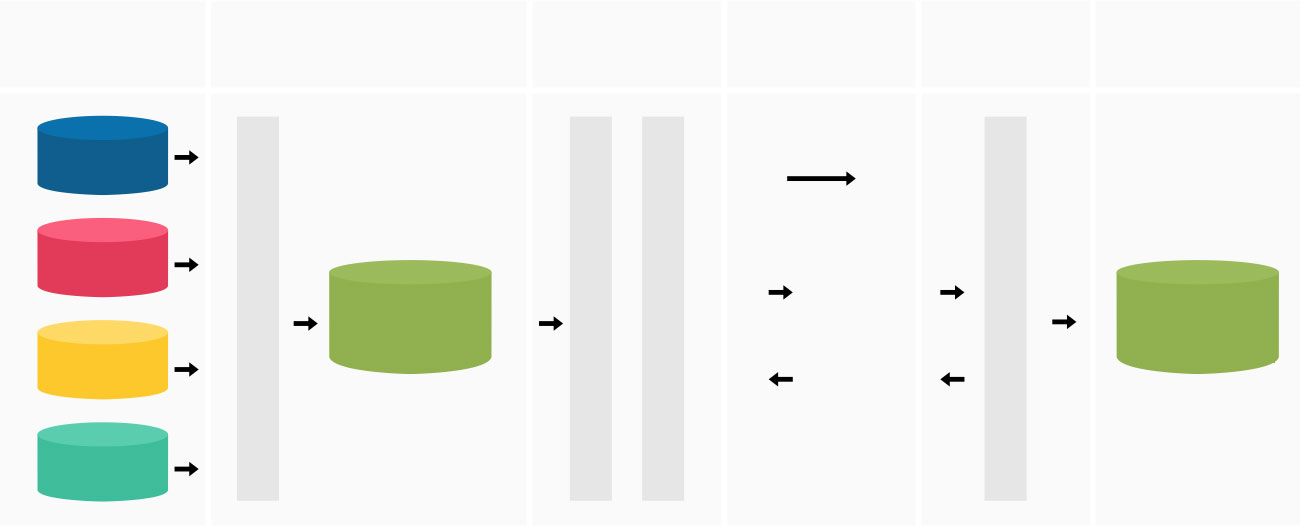

Conceptual end state architecture for banks to automated data submission

Nelito provides ADF/CIMS solutions for various players in the Banking system like urban cooperative Banks (UCB’s), district coop Banks (DCCB’s), NBFCs, Regional Rural Banks (RRB’s) and small banks. Our integrated Enterprise reporting can provide multiple reports like Regulatory, Risk and MIS reports to any regulatory across the globe. Our Integrated solution seeks an end-to-end automated enterprise reporting to perform independently in a holistic way for timely regulatory reporting.

RBI Initiative: Automated Data Flow (ADF) System

RBI depends on the data submitted by banks for its various functions. So, banks have to make sure that they submit correct and consistent data. To do so RBI has initiated the project on Automated Data Flow (ADF).

In the year 2010, the Reserve Bank of India (RBI) introduced a path-breaking initiative with Automated Data Flow (ADF) compliance which mandated an automated reporting system. Automated Data Flow requires a straight-through reporting process (STP) without any manual intervention and needs all business operations data to be made transparent in an automated manner to the RBI. Banks in India have to submit a set of 222 regulatory reports to the Reserve Bank of India (RBI) during different intervals.

The set of regulatory reports are classified into 12 categories:

- Basic statistical returns

- Department of Banking Supervision (DBS) returns analysis

- Statutory returns analysis

- Delinquency and collections

- Financial statements analysis

- Risk management

- Treasury

- Reconciliation

- Foreign exchange and international operations

- Fraud

- Advances

- Deposits

What is the RBI ADF approach paper?

The RBI approach paper on ADF implementation states the RBI seeks to ultimately achieve a state of complete automation for submission of reports by the banks from their core banking system solutions without any manual interventions. To reach this goal, RBI has segregated the return submission process into four logical processes.

- Data Acquisition – This requires interacting with and extracting data from various banking source systems and performing relevant data quality checks

- Data Integration and Storage – This needs to have a comprehensive data model that would enable the capture and storage of all relevant data elements

- Data Conversion – This needs to facilitate necessary data conversions and unification to create and submit the final report

- Data Submission – This has features to schedule report submission, review by relevant stakeholders and publishing in RBI mandated XBRL format

Regulatory reporting is one of the useful tools for RBI that helps them to understand the financial health of the banks. ADF project is an important step towards achieving the end state of accurate regulatory reporting.

Challenges in the regulatory reporting process and ADF project:

Regulatory reporting a tool for RBI that helps to understand the financial health of the banks in India. This information helps RBI in making certain macroeconomics decisions. It is therefore imperative that correct and accurate information is reported and submitted by the banks. The ADF project is a necessary step toward achieving the end state of accurate regulatory reporting. However, some challenges are underlying the regulatory reporting process and the ADF project.

- The unavailability of RBI Master Circulars or Guidelines

- The Qualitative Nature of Reports

- Banks’ Reluctance to Undertake CBS Enhancement

- Lack of Initiatives to Reengineer Existing Process

Assumptions in ADF:

- Maintenance of clean data in source systems by front-office teams

- Minimal operations inefficiencies while doing manual data entry in the source systems

- Seamless integration of the multiple source systems and the CDR for data sharing

- Successful execution of the Extract Transform Load (ETL) procedures at pre-defined frequencies

- Technology checks at various points to monitor jobs scheduling

- Intermediate data quality checks at various stages of report preparation

- Banks abiding by RBI guidelines in their day-to-day operations

- Cross-validation business rules across reports built into the ADF system to ensure data integrity

- Timely report generation and transmission to RBI in defined formats

Why is ADF thought of now?

With CBS in banks, it is felt that time has come to utilize CBS system capabilities to meet requirements like MIS, ADF, etc, in addition to regular transactional activities.

You can also read - Why Automated Data Flow (ADF) Goes Beyond Reporting for Banks in India?