Currently the most data-intensive sector that operates in a highly regulated market is the Banking and Finance Services (BFS) sector. The global compliance scenario in this sector is extensive, enclosing many regulations around finance and risk management functions, covering KYC, monitoring transactions against impending money laundering or fraud, financial reports, periodic disclosures, risk assessment and exposure reports, etc. Most of these tasks are manual in banks, which make these activities time consuming and susceptible to errors.

In order to remain competitive in an increasingly saturated market Robotic Process Automation (RPA) has become a powerful and effective tool. RPA drives efficiency benefits while providing regulatory compliance and deep analytical insights, along with improvements in quality, scalability and resiliency in a cost effective way.

Most of the financial institutions use RPA to gain a competitive advantage. But the fact that separates the winners from the losers is embracing it as a disruptive force and not just an enabler.

Recent RPA trends and forecasts report shows that by 2021, RPA will be $29 billion industry. That's huge increase from $250 million in 2016.

Robotic process automation helps in streamlining a wide variety of back office processes. The bank workers deal with huge customer data manually which not only is time consuming but is also prone to have errors. Hence most of the banks and financial institutes are now considering RPA to automate several processes in order to free up the manpower to work on more critical tasks.

The most common question that arises is RPA artificial intelligence?

So what is the difference between Robotic Process Automation and Artificial Intelligence?

RPA is a rule-based software automates repetitive tasks, while AI algorithms have the ability to learn and mimic human thinking like judgment based decisions, reasoning, cognition and perform tasks that require complex decision-making.

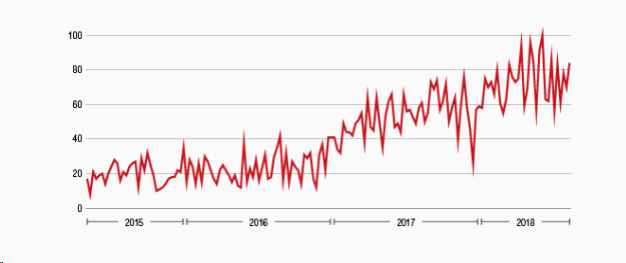

Google Trends for RPA

Search trends on Google show just how much the demand for robotics in banking has grown since 2016.

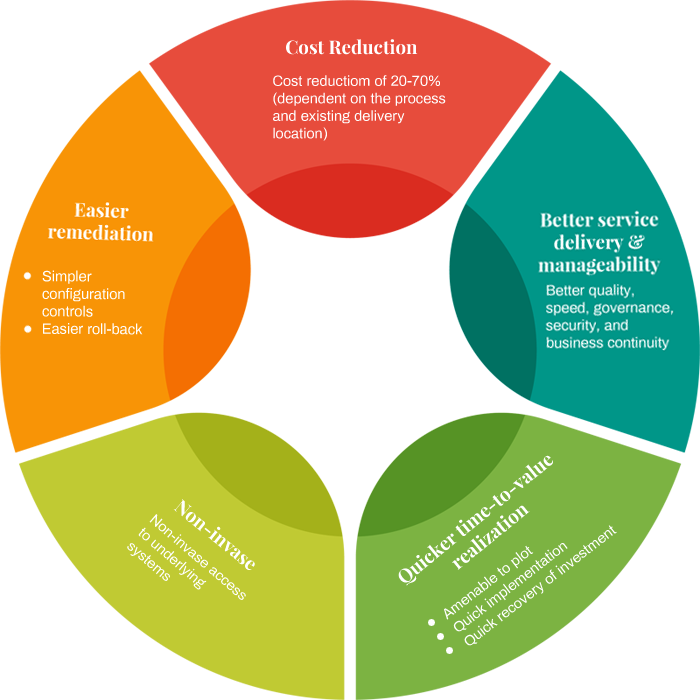

Benefits of RPA

- Increased compliance and eradication of human error ensuring higher quality

- Minimization in cycle times and constant process monitoring results in an increase in productivity

- It offers real-time monitoring and investigation

- Reduction in processing cost resulting in significant cost savings

- Swift implementation of new processes since process elements can be reused

- Though being an extensive solution, once in place banks achieve operational efficiency making processes faster and much more efficient

- Achieving business agility

- Growth of Legacy data and use of legacy data and new data to bridge the gap between processes

- Reduced business response time

- Leveraging the existing infrastructure as RPA does not require setting up of new infrastructure

RPA offers the potential for high value creation at relatively lower risk