5 Lending Management Trends in Indonesia for 2019

Updated On : October 2018In Indonesia, a huge market opportunity for alternative lending has led to the growth of a vast number of fintech companies in the past several years. Technology has invaded banking in a big way and transactions through digital channels are taking over the traditional branches in Indonesia. Banks are trying to keep pace with this change and changing strategies rapidly. In such a market scenario, let us look at 5 trends to look out for in 2019 in Lending Management in Indonesia.

P2P Lending

In Indonesia, the development of fintech companies is likely to disrupt financial services, especially credit lending service which is the main business of conventional banking companies. Many fintech companies perform the same services with much more efficiency for consumers by using the peer-to-peer lending (P2PL) business model.

With an innovative peer lending platform, these P2PL fintech companies are able to match money lenders and borrowers and lend directly and at a much lesser cost than conventional banks. Hence the intermediary third-party like banks becomes obsolete. Borrowers can also pay lesser interests than conventional banks charge, and earn greater returns, as the intermediary is eliminated.

The growth of these Fintech companies will take over market share in the future and lower the profits of the conventional banks.

With fintech companies having a peer-to-peer lending business model posing as a risk to conventional banking companies, it is crucial to explore the business of peer-to-peer lending fintech companies and their capabilities as it will help to identify and analyze a conventional bank's business risk.

Marketplace Lending

In the broader Indonesian economy, a significant cost is factored due to lack of access to credit. This spells a lost opportunity amounting to approximately 14% of GDP5. Marketplace lending can provide better access to credit for a majority of Micro and SME businesses (MSMEs).

Marketplace lending is predicted to be a transformative force in Indonesia. However, towards this end, fintechs, banks and regulators will need to collaborate and work on getting three things right

It is important to focus on lending practices that are sustainable rather than just looking for quick growth. For the future of the nascent industry, it is essential to build customer awareness and add value to businesses beyond just lending.

Instead of trying to create entry barriers and unnatural advantages, banks should get together and provide healthy competition to fintechs and leverage the various core advantages like low-cost funding.

As for the regulators, while keeping compliance costs down, they should prepare the industry with protective mechanisms to prevent it from growing too big and also keep complete vigilance.

Credit Risk

One of the top challenges to growth is credit risk and almost all bankers have it on their priority list. With credit risk truncating loan growth, the challenge will be to see whether credit risk management will improve and reach a better level in 2019. Credit risk was at second place in 2017 and moved to fourth in 2018. This does reflect a positive position on NPLs and a better outlook, but bankers are still careful about the credit risks that the sector carries along. Large state owned banks respondents did not consider credit risk in their list of top five risks.

In Islamic Banking, credit risk is still a major concern, which causes financial instability in banking. According to The Bank for International Settlements, to have a suitable credit risk management system, banks must first identify, then measure and examine and then control the credit risk properly. If the credit risk is measured accurately, it helps to develop apt monitoring and control mechanisms to manage it. Thus, measuring credit risk in the Islamic banking system is crucial for all bank stakeholders as falling GDP levels cause a lot of bad loans in Indonesian Islamic banking.

Front-end customer platforms

The banking industry has been revolutionized by digital technology in the developed markets and is now sweeping through rising markets. A survey by McKinsey shows that financial-services customers in the Association of Southeast Asian Nations (ASEAN) are progressively sophisticated and are set to accept digital and mobile banking, which will change the industry's regional landscape.

A recent survey indicates rapid changes in banking products and services that young and affluent consumers want throughout ASEAN. Thus, tech spending is mostly concentrated on front-end systems. An important aspect is the increasing importance of customer needs which are changing. This is forcing banks to relook at the way they conduct business. It was also observed as the number one driver for transformation by one third of respondents in the same study, which is an increase from last year.

The customer centric focus is also apparent in the way a lot of banks are moving their tech spending to front-end web or apps or e-banking systems.

State owned banks are also focusing on core systems apart from front-end technology.

Consumer loan growth

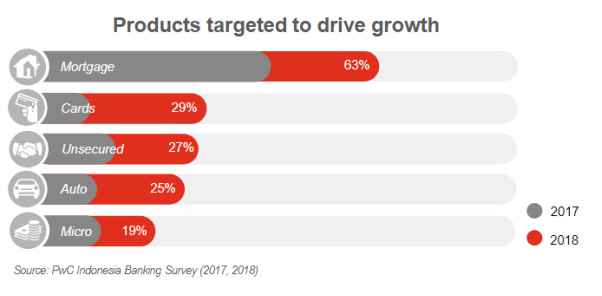

Consumer loan growth was stronger in 2018 than 2017 and is expected grow even faster in 2019. In 2017, 57% of respondents expected loan growth to be in excess of 10% . In 2018, it expanded to 71%. In 2019, the expectations are even higher.

In 2017, due to the broad increase in NPLs there was a premium on collateralized lending such as mortgages. In 2018, there is an increased interest in all consumer categories.

Mortgages still rule as the main focus but there is a great deal of competition expected across all consumer categories. The market is today charged about consumer lending, especially unsecured lending, while it remains to be seen whether banks have the required active systems and data analytics to price, monitor and manage risk suitably. For not many banks with ambitious growth plans in consumer lending may be prepared for risk management.

References -

- Authors: Kharisya Ayu Effendi, Rozmita Dewi Yuniarti, Year Published: 2018, Publication Title: Credit Risk and Macroeconomics of Islamic Banking in Indonesia, Accessed Date: Jan 2019

- Authors: Sonia Barquin, Vinayak HV, Heidi Yip, Year Published: 2015, Publication Title: Digital Banking in ASEAN: Increasing Consumer Sophistication and Openness, Accessed Date: Jan 2019

- Authors: David Wake, Lucy Suhenda, Year Published: 2018, Publication Title: 2018 Indonesia Banking Survey - Technology shift in Indonesia is underway, Accessed Date: Jan 2019

- Authors: Jason Ekberg, Ritwik Ghosh, Iwan Kurniawan, Year Published: 2016, Publication Title: Time for Marketplace Lending - Addressing Indonesia's Missing Middle, Accessed Date: Jan 2019

Comments :