The Growth of Digital Lending in SouthEast Asia

Updated On : September 2018

Digital Lending is an online platform that borrowers and lenders make use of, in the absence of a traditional bank as an intermediary. South East Asia has large chunks of rural areas that are completely unbanked in the less developed ASEAN countries such as Cambodia, Indonesia, Vietnam, Myanmar and the Philippines. Although traditional banking is making slow inroads here, technology has been quick to catch up.

The financial organisations on the other hand, are working hard to ensure that customers can manage and take care of their wealth management, capital market, banking or e-commerce transactions on any mobile device, whenever they want, from anywhere in the world. Customers, today, while investing their money to grow with reliable and effective financial services also want complete control of their funds.

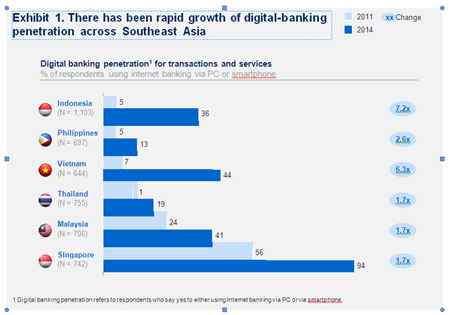

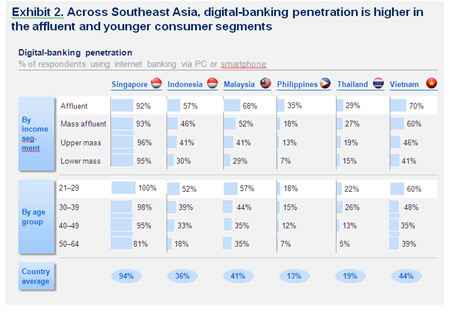

The banking industry is also fast coming to terms with the digital reality where consumers are embracing digital banking either through their handheld (Smart phones) devices or their computers. As per market survey findings, in emerging Asian markets, Smartphone banking penetration has been seen to grow at a faster pace , jumping two-to-five-fold as compared to overall digital banking.

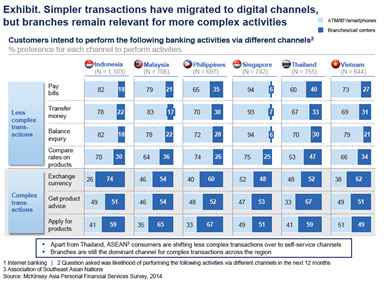

The phenomenal growth of digital banking has also led to the advent of disruptive trends, where one can now see a declining relevance of physical bank branches with an ever increasing threat of digital players capturing a substantial market share.According to Published Report by Mckinsey & Company "Asia's Digital Banking Race, dated Feb 18, "There has been a fair amount of growth from an average of 12.7% to 14.9% in on the overall customer engagement transaction in Developed Asia, and from 6.0 to 8.1 in Emerging Asia, which shows an increase in the usage of Smart phone devices to access the internet for financial transactions.

The ever growing lot of new-age fintech companies have also now started venturing out from the traditional payments and transactions. They are coming with innovative offerings in areas like lending & investments too which traditionally used to be a part of banking revenue streams. These disruptions caused by new-age digital players will have a direct affect on the volumes and margins of the traditional banks.

There has been an increase in the borrower expectations vis-à-vis the marketplace and the digital experiences in other industries. Also, while the interest rate and costs are still primary considerations, the overall customer experience in terms of speed, service and transparency is very important.

The competition in the digital lending space is ever increasing & lenders (Banks & Non-banks) should start taking advantage of newer technologies which would allow them to make their engagements with the customer simple & faster. Also digital lending solution is not only about converting paper to digital documents, but a step that would help automate many processes and turn borrowing into an efficient, painless & quick process.

The traditional way of consumer borrowing process needs a lot of improvement in terms of enhancing the overall borrower experience. Nelito's Digital Lending platform is helping to transform the consumer loan industry in terms of providing greater simplicity, efficiency & transparency. The solution enables banks & alternative lenders and helps them thereby ensuring an accelerated growth in their portfolio size and increase in revenue opportunities.

Nelito's digital lending solution have allowed Lenders (Banks & Non-Banks) to leapfrog over other solutions to provide customers with a faster, transparent, & a very convenient service. The advancements made by Nelito in the Digital Lending space makes it the ideal destination for banking &NBFCs of all sizes. Through the use of the digital lending platform, the ability to service more customers in a faster pace is achieved. It would also help Banks & Non Banks to concentrate on quality tasks such as building enhanced customer relationships.

Nelito's Lending Solution offers the following advantages:

- Reduction in Origination Costs

- Significant reduction in back-office inquires

- Complete 360 degree view of all customer interactions

- 100% view of data analytics in one single platform

- Ability to Plug & Play over multiple connectors

Conclusion Nelito's Digital Lending platform solution offers and provides financial institutions immense benefits and advantages while helping them "to improve their productivity", thereby ensuring closure of more loans and increase revenue per loan with better automated services which are economical & efficient.

References -

- Digital Banking in ASEAN – McKinsey & Company Limited

- Asia's Digital Banking Race – McKinsey & Company Limited

Comments :