Overview - EMI Collection & Debt Recovery Solution

Nelito's EMI Collections is a mobile based solution offering the staff or agents of the financial institution with a robust tool for tracking, collecting Loan EMI's and maintaining records of the customers' real-time on the field. This Loan EMI collection solution is an innovative solution by considering importance of loan recovery process for banking and financial services industry.

This significantly aids banks and financial institutions as they can optimally utilize their resources, bringing about an upsurge in the overall debt recovery and brings complete transparency in the process. The EMI collection solution has an inbuilt module for an agent onboarding and rewards calculation.

Nelito's Lending Collections Software helps track & manage delinquent customers and minimize delinquencies using tighter supervision.

The solution comes with MDM (Mobile device management) suite and supports the BYOD (Bring Your Own Devices) model of operations. The collection system enables proactive actions through all stages from soft calling to hard bucket collections. Our loan EMI collection solution incorporates with the loan management system and picks up non-performing loans.

It also helps in integration with mobile platforms to deliver swift and paperless transaction processing with reduced risk and higher limpidity. The solution efficiently addresses optimization of collection processes, real-time view of recovery status and compliance with legal procedures of the country.

Benefits

- Reduced cost and increased productivity

- Agents can handle the complete end to end process of collections on the field considerably reducing the time and cost for the operation

- Real-time, transparent process results in increased trust on collection agents and instant query resolution through information available in the solution

- To decide the best strategy for classification, allocation and follow-up Actions

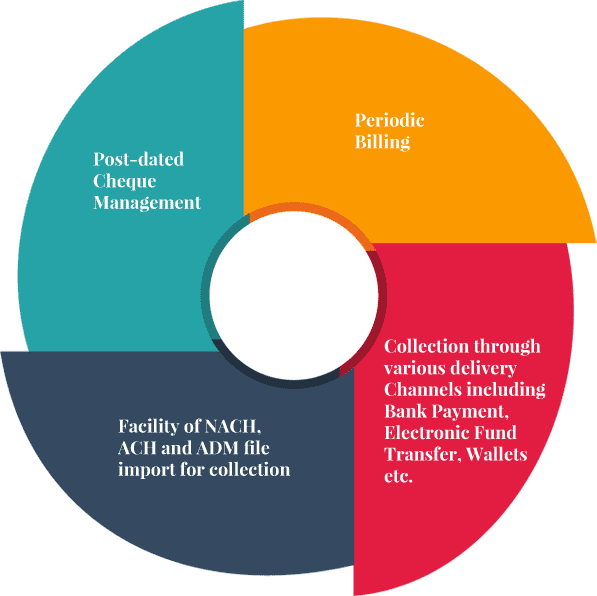

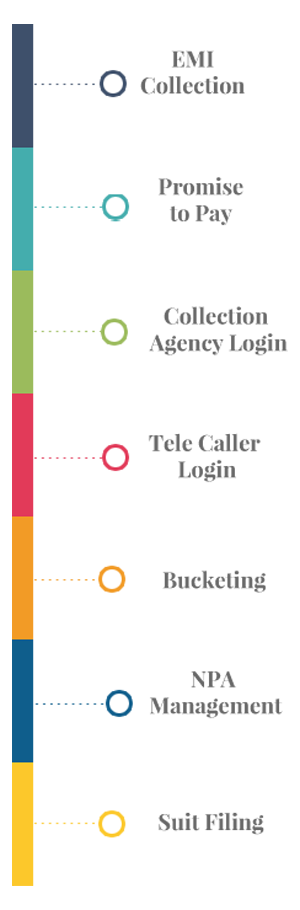

Activities of EMI Collection Solution

Collection and Recovery

Testimonials

-

The project headed by Mr. Prashant Hedge & team have put their good efforts in Implementing new ASP software successfully which is as per our satisfaction.

Maheshwari ( IT Head )Vikramaditya Nagrik Sahakari Bank Ltd

-

We have successfully made Nelito's Fincraft Software for NBFC live in early March for LOS,LMS and Sanjiv Khalkho, Arijit Chakraborty with his team have been very instrumental in making this software live . I would like to appreciate on the turnaround time during the go live phase of the team in getting some of our key requirements done and helping our users to use the software for recording and disbursing all the sales from the software.In technology side I would like to praise Pramod Navale and Ganesh Khetmalis for in depth knowledge of the product and their technical skills is outstanding. Looking forward for the continued relationship for our next release and whole of 2018.

Prateek P Katyal ( CTO )WheelsEMI Pvt. Ltd

-

Our bank is using Fincraft, CBS of Nelito system since 2011. The application is functionally rich & user friendly and easy to navigate. The convenience of integrating other supporting applications of Nelito CTS, NEFT, RTGS, HO Module (share), Loan Origination, Internet Banking etc. helped us in smooth automation of various banking operations. We are very much thankful for providing such a good technology of coop banking sector and hope better performance in coming days. Wish You All the Best.

Gunvantbhai Shah (Vice Chairman)Mahudha Nagrik Sahakari Bank

-

"Nelito has Good knowledge of industry. Good customer orientation. They were Flexible and Open to new ideas and suggestions."

Mr. Ratheesh K. BharathanExec. Vice President & Co- Founder

-

"The best mix of functionality and technological support and our vision of "Cash Less and Paper Less" work environment for Sonata has come true with our technological partner Nelito. I highly recommend FinCraft Core Microfinance platform and especially integrations with a number of third party services."

IT HeadSonata Finance Pvt. Ltd.

-

Overall we are happy with the services provided by Nelito. The implementation team is sensitive to our support requirements and does a good job.

Vinayak Khadye (Chief Digital Officer)Finanzmart Services Pvt Ltd

-

For a Bank of our size, this system suffices and is very cost effective. Almost all of the bank's activities run on the one system. Nelito constitutes a partner more than a supplier and the relationship includes provision of the bank's underlying technology as well as its Fincraft range of applications.

ChairmanThe Nainital Bank Ltd.

Happy Clients

News

-

![economic times]()

March 2019 - Nelito welcomes their new client – Alliance for Microfinance in Myanmar!

-

Nelito got featured in India's leading publication - The Economic Times

Agility is very important as it sets the banks apart. Banks function slower as compared to the NBFCs, which is why agility is important.

-

NELITO FEATURES IN IBS'S ANNUAL SALES LEAGUE TABLE 2017 (LENDING)

Nelito's award winning FinCraftTM Integrated Lending Management Solution has been included in IBS's Annual Sales...

-

![solutions for bfs market]()

Solutions For The BFS Market The afternoon

-

![PTI News]()

Nelito Systems Receives Global Accolades for Innovation in Lending Management Software Press Trust of India