What Drives Open Banking Success?

Updated On : September 2020

Open banking is the route to a robust, sustainable, and comprehensive payments ecosystem. It opens opportunities for greater customer value.

In current scenario, one concept that is gaining ground and is inevitable in the future is open baking and few markets, directed by the UK and EU, have already taken the lead by forming and passing their own open banking regulation.

Other markets, such as Australia, Canada, New Zealand, Mexico, Argentina, Nigeria, Hong Kong, Japan and Taiwan, for example, are also moving in that direction.

5 ecosystem requirements for successful open banking

- APIs: These are the mechanisms by which bank interact with others in the digital ecosystem.

- Enabling Assets: These will likely include Digital identity and access management, consent management and data and analytics.

- Use Cases: For open banking to prioritize use cases, Banks will need to go beyond compliance to develop a set of core objectives.

- Killer Apps: Banks will need to offer their customers amazing experiences through apps.

- Partnerships: These could range from simple data sharing agreements to deep strategic service partnerships.

Factors which may in due course determine the success of open banking are as belows

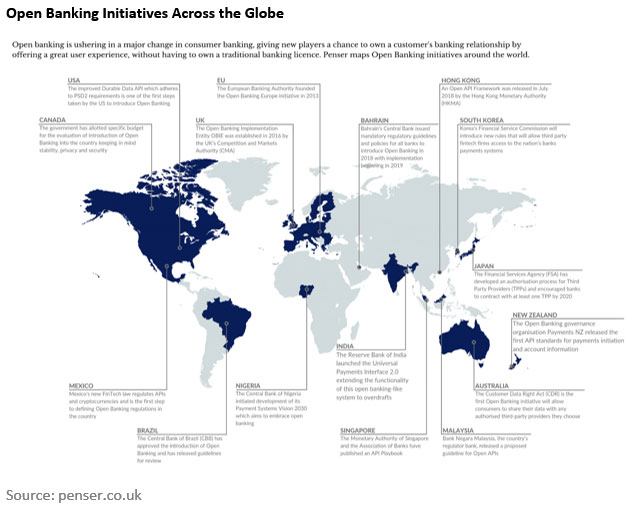

Open Banking Initiatives Across the Globe

- Canada: The government has allotted specific budget for the evaluation of introduction of Open Banking into the country keeping the mind stability, privacy and security

- USA: The improved durable data API which adheres to PSD2 requirements in one of the first steps taken by the US to introduce Open Banking

- Mexico: Mexico's new FinTech law regulates APIs and cryptocurrencies and is the first step to defining Open Banking regulation in the country

- Brazil: The Central Bank of Brazil (CBB) has approved the introduction of Open Banking and has released guidelines for review

- UK: The Open Banking Implementation Entity OBIE was established in 2016 by the UK's Competition and Markets Authority (CMA)

- EU: The European Banking Authority founded the Open Banking Europe initiative in 2013

- Nigeria: The Central Bank of Nigeria initiated development of its Payment systems vision 2030 which aims to embrace open banking

- Bahrain: Bahrain's Central Bank issued mandatory regulatory guideline and policies for all banks to introduce Open Banking in 2018 with implementation beginning in 2019

- India: The Reserve Bank of India (RBI) launches Universal Payments Interface 2.0 extending functionality of this open banking – like systems to overdraft.

- Singapore: The Monetary Authority of Singapore and the Association of Banks have published and API Playbook

- Hong Kong: An Open API framework was released in July 2018 by the Hong Kong Monetary Authority (HKMA)

- Malaysia: Bank Negara Malaysia, the country's regulator bank, released a proposed guideline for Open APIs

- South Korea: Korea's Financial Service Commission will introduce new rules that will allow third party fintech firm access to the nation's banks payments systems

- Australia: The Customer Data Right Act (CDR) is the first Open Banking initiative which will allow consumers to share their data with nay authorised third-party providers they choose

- Japan: The Financial Services Agency (FSA) has developed an authorisation process for third party providers (TPPs) and encouraged banks to contract with at least one TPP by 2020

- New Zealand: The Open Banking governance organisation Payments NZ released the first API standards for payments initiation and account information

You may also like to read

What is Open Banking and its Boost to Innovation?

The Future of Banking – Exciting Times Ahead

Sri Lanka: Digital Transformation through Open Banking Framework

For In-depth solution knowledge, request a demo today!

Comments :