Sri Lanka: Digital Transformation through Open Banking Framework

Updated On : July 2020

COLOMBO – The Central Bank of Sri Lanka (CBSL) promotes open banking framework for Sri Lanka to enhance the access to financial services and drive financial technology (FinTech) innovations in Sri Lanka. An Open Banking Framework provides a governance to enable customer-consent based online sharing of financial data with financial service providers using Open Application Programming Interfaces (APIs).

Further, it is expected that an advance secure way of banking due to an open banking framework would brace up the association between banks, FinTechs, Financial Services providers and consumers.

What is an Open Banking Concept?

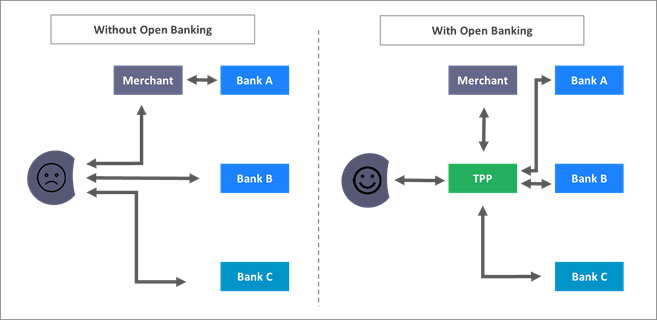

Open banking also known as "open bank data", is the practice of sharing financial information electronically, securely, and only under conditions that customers approve of. Application programming interfaces (APIs) allow third-party service providers to get access to financial information efficiently, which promotes the development of new apps and offer value-added services to enhance customer experience. Open banking is becoming a major source of innovation that is poised to reshape the banking industry.

Open Banking is already popular in Europe and in the Far East where it's governed by PSD2 (European regulation for electronic payment services), which is the regulatory framework that sets standards for information sharing and security on Open Banking APIs.

Open banking regulation required providers of banking services to open up their customer data to authorized third-party providers via APIs. As a result, an ecosystem of APIs is created with various third parties integrating with banks to reinvent financial services by using customer data.

Why Open Banking in Sri Lanka?

The Banking and Financial Services industry is going under profound transformations as a result of emerging technologies (APIs, Analytics), growing customer needs, new players in the market and regulatory rules (PSD2, GDPR). These factors are pushing incumbents to revise their models to uphold their positioning and keep up margins. An increasing trend towards open banking in the world has been observed. Countries like UK, Japan, Hong Kong, Australia and members of the European Union have introduced open banking for the benefits it provides to the customers.

Open banking framework has been introduced in Sri Lanka to enable FinTech innovations, Financial inclusion and to help customers manage their finance more efficiently. The regulatory, technology, competitive and customer push were the pushes which led Sri Lanka towards Open Banking.

Comments :