The Role of Technology in Microfinance – Digital Transformation

Updated On : July 2021

In India, the first initiative to introduce microfinance was the Self-Employed Women's Association (SEWA) in Gujarat, which established SEWA Bank in 1974. Since then, this bank has been providing financial services to individuals who wish to grow their own businesses in rural areas.

Microfinance industry has become a driving force for including people who are unserved by the existing financial service providers. India's microfinance sector is fragmented with more than 3000 microfinance companies.

Micro finance is trying to bridge the gap between the financial service providers and financially excluded population. Technology, innovation and knowledge have become the key drivers of economic growth today.

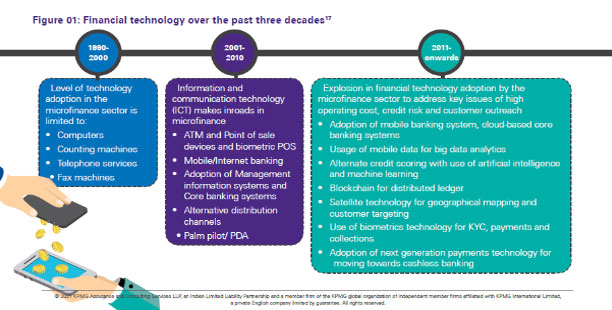

Digital technologies are rapidly spreading across the world and are making inroads into all realms of human life. Digital innovations are creating new channels of engagement, expanding opportunities and increasing efficiency for individuals, businesses and governments. The microfinance industry across the world is also fast adapting itself to technology changes in the financial sector. Increased connectivity and technological innovations allow a range of developmental benefits, digital dividends, which could boost growth, expand opportunities and improve service delivery.

The features of technology in MIF’S are

- 1. Customer centricity: Digital technology and data allow financial service providers to more effectively serve the financially excluded with a “customer-centric” approach.

- 2. Reducing operational risk: Through digital technology, clients have the flexibility to repay loans through their mobile phones, avoiding the risks of cash-in-transit.

- 3. New business models: Mobile banking supports new business models through mobile technology and data analytics in credit scoring, decision and underwriting processes.

- 4. Partnerships and collaboration: Partnerships and collaboration between telephone and tech companies can help to change the financial services industry.

- 5. Consumer protection: By leveraging the nearly ubiquitous growth of mobile phones, digitization can reduce cost, increase efficiency and allow financial service providers to reach new clients.

By developing an inclusive and sustainable digital financial ecosystem through substantial investment, skilled resources, adequate infrastructure, agile processes, and a conducive regulatory environment, it can foster more widespread adoption and usage.

By developing an inclusive and sustainable digital financial ecosystem through substantial investment, skilled resources, adequate infrastructure, agile processes, and a conducive regulatory environment, it can foster more widespread adoption and usage.

IT intervention into Microfinance Industry enhances the overall efficiency of the sector. Banks and Microfinance Institutions are investing heavily to bring advancements in usage of IT in the process of lending which makes the task simpler and thus help the institutions to increase reachability of the services, Indian population especially in the rural areas are resistant to technological changes that is acting as a major barrier in the effective utilization of the services.

Thus, IT intervention in Microfinance industry can achieve trusted results only upon educating the rural population about the benefits of the same by conducting regular sessions, awareness campaigns, and workshops to guide the clientele on usage of IT services will help the industry to benefit extensively through this move of the country.

Comments :