Neo Banking - What’s so ‘Neo’ About it?

Updated On : October 2020

Banking as a business is undergoing rapid changes. The products and services which are being built with disruptive technologies are offered to the end customers. The banks are changing their behaviour according to customer convenience, transparency, pricing and customer service. The business and operational models of the banks in turn change according to customer behaviour and expectations.

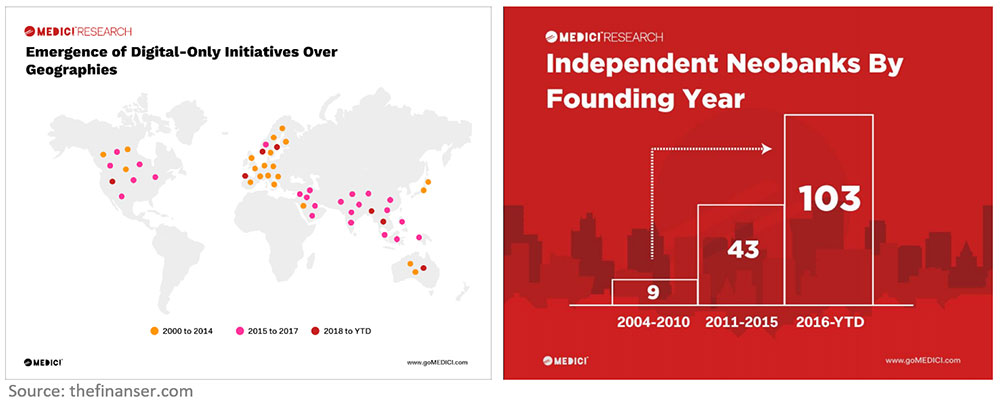

All banking services for customers are now available through a non-banking service provider with technological prowess and agile and lean business models. With these models, a bank’s retail and SME services are mostly delivered through the internet or through other electronic channels, through non-banking service providers or through Neobanks. Today, Neobanks are taking over the fintech industry globally by storm. They are challenging the traditional banks by offering lower cost models and customer-centric customized services and experiences.

With the financial landscape shifting towards customer experience and satisfaction, the gap between what the traditional banks offer and what customers expect is widening. Neobanks are rushing in to fill that gap.

Where traditional banks have a lot of constraints regarding legacy systems, closely integrated value chains, intricate administrative structures and difficult regulatory requirements, neobanks have none. In India, Neobanks don’t have their own bank licences and use partners to offer bank-licensed services. Hong Kong’s ZA Bank is the first out of eight virtual banks to get a banking license in 2019 and launch services in neobanking. ZA Bank’s initial service offering lets about 2000 users try its services that include remote account opening, time deposits, local transfers, multi-currency savings account, and e-statements.

Neobanks offer the conveniences of opening and operating accounts, seamless payments, transfer and remittance solutions and alternative methods for assessing creditworthiness. These features are attractive to micro and small companies and underbanked or unbanked customers such as freelancers and gig economy employees. Neobanks cater to these segments with access to financial services and products, which were scarcely available or came with heavy fees and stringent agreements. Neobanks are fintech firms with services ranging from digital and mobile-first financial solutions payments to money lending, money transfers, and much more.

Today, over 75% of all customer interactions with banks are done digitally. While traditional banks have invested in their own web and mobile platforms and are trying to cater to the customer, they are still lagging behind the capability of their neo-counterparts. Neobanking apps are being upgraded continuously to cater to customer needs.

Features of neo banks

- Being customer centric, Neobanks provide personalized services to their customers that are fired up through technology.

- The decision-making process of a Neobank is data driven. With their modern platforms, it is easier for them to collect and analyze data and recognize how their customers behave in the neobanking ecosystem. Based on these analyses, they create customized services for customers.

- On an average, neobanking apps are adding nearly double the number of new features as compared to traditional banking apps and are delivering almost three times more app updates every year.

- Neobanks excel in terms of performance, running 42% faster than incumbents.

- They solely focus on the customer experience which has resulted in user satisfaction ratings for Neobanks in the US (90%) being much higher than that of traditional banks (66%).

- They offer hassle free services such as creating and operating a savings account, payment of bills or money transfers, loans to individuals and businesses, and other such services directly on their mobile phone or via any other digital platform.

- Neobank apps are user friendly, intuitive and follow a clean style design. They’re highly responsive and suitably designed to cater to the customer.

- Transactions made via Neobanks are immediate. Hence, the up to date transaction details and account balances are provided instantly, along with a savings goal which can be customized to help manage finances better.

- It is also beneficial for a traditional bank to partner with Neobanks as it helps to overcome the loopholes of the current banking systems along with improved quality of banking services.

- Another very important and impactful benefit for traditional banks is the Neobanks’ ability to augment the distribution network of incumbent banks.

- With a Neobank partnership, traditional banks can save in-house research costs for providing their customers a better experience. They have an option of choosing from multiple FinTech companies who will do the research for them.

You may also like to read

The Next-Gen of Digital Banking

The Advantages of Mobility Solutions in the Digital Age

What Drives Open Banking Success?

For In-depth solution knowledge, request a demo today!

Comments :