Challenges faced by Microfinance Institutions

Updated On : May 2016 | by Amol S. Khanvilkar

Milton Friedman once said that "the poor stay poor, not because they're lazy, but because they have no access to capital." Till date, a huge section of population remains outside the formal banking system. Microfinance institutions are the only ones equipped to reach the 'unbankable' or 'unbanked' masses, and make financial services accessible to them.

Requirements and challenges faced by Microfinance institutions:-

Microfinance institutions serving retail customers have to face quite a specific set of challenges, which cannot be addressed with solutions meant for commercial banks. These challenges include:

- Cost of outreach - reaching the unbanked populations of the world means servicing small loan amounts and servicing remote and sparsely populated areas of the planet, which can be dangerously unprofitable without high rates of process automation and mobile delivery.

- Lack of scalability - smaller microfinance systems often struggle to preserve the profitability and performance in these markets, as FI's experience high growth rates that result from getting the service delivery right. This results in thwarting the growth of these organizations.

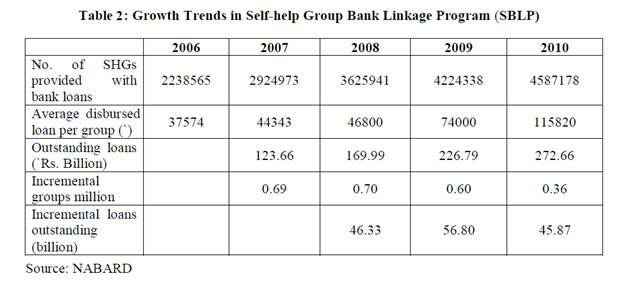

- Quality of SHGs (Self Help Groups) - Due to the fast growth of the SHG-Bank Linkage Programme, the quality of MFIs has come under stress. This is due to various reasons such as:

- The intrusive involvement of government departments in promoting groups

- Diminishing skill sets on part of the MFIs members in managing their groups.

- Changing group dynamics.

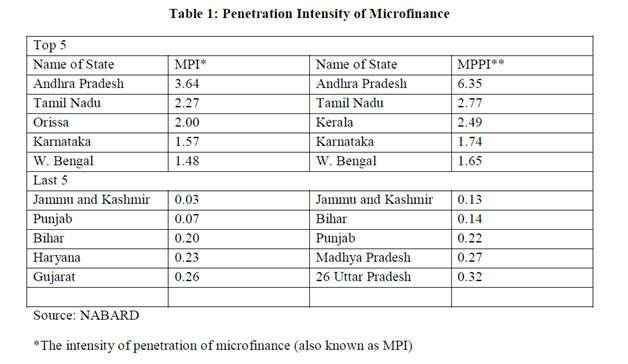

- Geographic Factors - Around 60% of MFIs agree that the Geographic factors make it difficult to communicate with clients of far-flung areas which create a problem in growth and expansion of the organization.

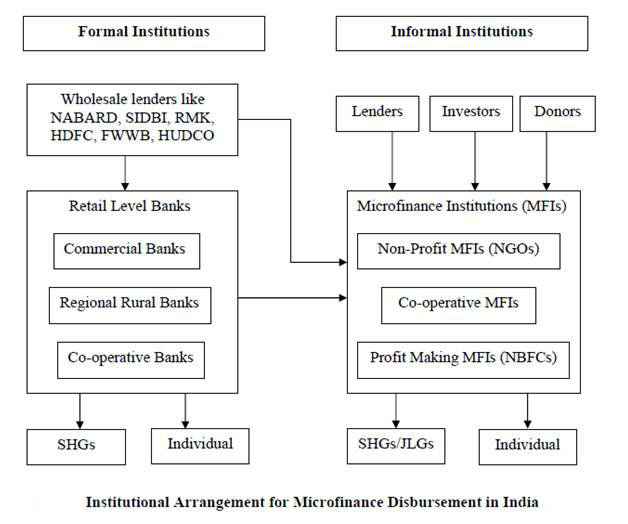

- Diverse business models - Supporting the very wide range of features and lending activities is difficult and requires a considerable amount of cost and efforts.

- High Transaction Cost - High transaction cost is a big challenge for microfinance institution. The volume of transactions is very small, whereas the fixed cost of those transactions is very high.

- KYC and security challenges – The customers serviced by Microfinance instructions are usually the ones having none or very limited official identification or able to provide tangible security, this makes it extremely difficult for institutions to offer any banking services.

- Limited budgets – Making provisions for large upfront investments is not possible for most of the MFIs which limits their capability to purchase world-class banking solutions that can help them fulfil their requirements and support their growth targets.

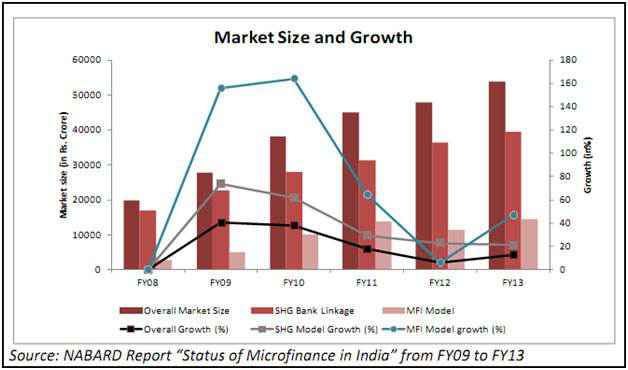

No doubt, microfinance institutions have shown impressive growth and have been instrumental in the cause of financial inclusion, but a lot remains to be achieved.

Solutions for Microfinance sector

Nelito's FinCraft Microfinance Solution is an integrated banking software solution for microfinance institutions (MFIs), active in both group and individual microfinance lending.

It provides MFIs with world-class banking capabilities that usually are only accessible to larger commercial banks with significant IT budgets.

Its Agency/DoorStep Banking feature helps agents to do various banking activities on the field such as Customer On-Boarding, transactions, collecting daily deposits, EMI collections which were earlier limited to branch networks. Other modules like Self-Help group help in managing the complete lifecycles of SHG's.

FinCraft Microfinance solution can be delivered on premise or via the Cloud

You can check Nelito's Solution for Micro Finance here.

Comments :