Neobanks: The Next Evolution of Digital Banking in India

Updated On : Oct 2022

What are Neobanks?

Neobanks are digital banks that don't have physical branches; they offer services that traditional banks don’t offer and operate fully online. They have leveraged technology and artificial intelligence (AI) to offer personalized services to their customers while minimizing their operating costs.

In India, Neobanks don’t have a bank license, but they are dependent on bank partners to offer licensed services because the Reserved Bank of India (RBI) has not yet allowed banks to operate 100% digitally.

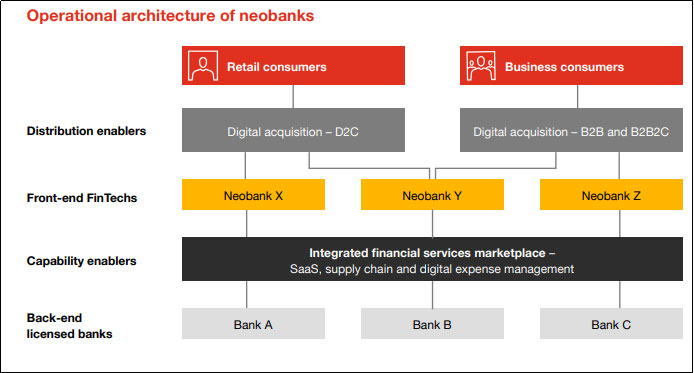

Operational architecture of Neobanks:

Source: PwC analysis

The Indian model of Neobanks-partnerships with licensed banks:

- Regulated

Indian Neobanks are fintech organizations that are not directly regulated by the RBI; they partner with banks and NBFCs to provide their financial services via digital platforms.

- Branches

Neobanks in India do not have any physical presence. They interact with customers via digital medium. However, customers can still access the physical branches of partner banks or other financial institutions

- Scope of Services

The services offered by neobanks are: opening bank accounts, loan/credit facilities, prepaid card services, insurance services, etc. Neobanks, which serve the MSME sector, provide solutions like the preparation of invoices, expense management, and vendor payment management.

- Permissibility

The neobanks (partnership business model) in India do not have any restrictions on their operations.

- Compliance

Neobanks in India are not directly subjected to any compliance by the RBI. The partnerships with regulated entities are governed by RBI’s outsourcing regulations, Master Directions on Digital Payment Security Controls, and Business Correspondent Guidelines. The guidelines apply to the partnering regulated entities and the applicability depends on the nature of services offered by neobanks.

Advantages of using Neobanks:

-

Simplified online processes for opening accounts and customer onboarding.

-

Neobanks give 360-degree views to their customers with the help of unified dashboards, which help in providing key insights to customers like due bills, bank statements, etc.

-

Neobanks have a transparent fee policy, i.e., they don’t impose hidden charges/fees on their customers.

-

To enhance customer engagement, Neobanks provide several other services, like tax filing, curated e-commerce, and automated accounting.

-

Neobanks' products or services are protected by robust security and technology infrastructure

India’s top Neobanks:

- RazopayX

It was launched in 2018. They offer services for business owners and online merchants to automate repetitive financial tasks and manual tasks and provide money flow insights. It simplifies payouts, offers credit solutions, and provides ledger support on current accounts.

- Jupiter

It was launched in 2019. They offer services like cash withdrawal, savings accounts, money transfers, and NFC prepaid cards. It offers dashboards for viewing balances and monitoring transactions.

- Niyo

It was launched in 2015. They offer zero-balance accounts with different facilities like free accidental insurance, salary advance, forex cards, and tax-saver cards, which help the users track and claim employee benefits.

- Open

It was launched in 2017. This Neobank is for businesses and start-ups, which offer services like money transfers, deposit accounts, debit cards for online/offline purchases, and invoice management.

- EpiFi

It was launched in 2019. It offers digital banking services like savings accounts, prepaid cards, money transfers, and bill payments. It helps in savings along with interest and gives insights into the money.

The market size of global Neobanks is expected to rise to $333.4 billion by the year 2026. Neobanks are gaining momentum and have the potential to disrupt the banking and financial sectors, but their operational model has not yet achieved sustainable profitability.

Nelito offers customized solutions & services for its clients from finance and other sectors. To know more about it, write us at marketing@nelito.com or visit us here.

Comments :