Credit scoring for Lending - A new perspective

Updated On : May 2018 | By Nitin Alkari

NBFC: Credit scoring on the basis of non-financial data.

Many people in India still do not have the adequate footprint of financial data due to lack of bank accounts and channels for the payment / repayments.

In such scenario it becomes important to create alternate ways of credit scoring. Due to the explosion of the new age platforms such as Mobile, Smart Phone, Facebook, POS, ATM, Internet Banking, Mobile Banking and many alternates in the Mobile Banking, the footprint of data in everywhere; the need is to pick up the right one and leverage it.

Now the following mediums are used to understand the credit history:

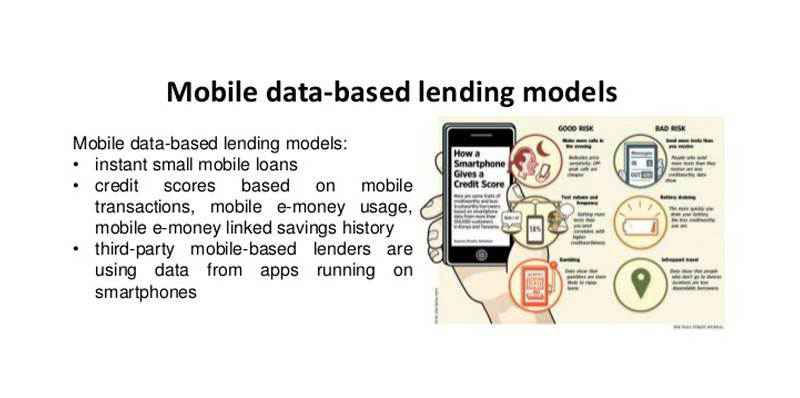

Data based on Mobile phone usage

- 590 million users in India use mobile phones.

- A person using mobile phone on each occasion such as a call, text, browse etc. leaves behind a trail of the transactions or usage

Source: https://www.slideshare.net/johnowens/alternative-data-transforming-sme-finance-76880237

Data based on social media usage

- 134 million users in India uses social media

- The use of the social media provides the insight on the demographic data such as age, occupation, likes, dislikes, geography, reach and acceptability with others

Source: https://mynationwidecredit.com/can-credit-score-go-social-media-activity/

Data based on the behaviours

- The behaviour of the person is judged on the basis of certain tests. The tests are based on the social standing, Intelligence, Beliefs and the type of personality. The judgments can reduce the default rate to a great extent

Source: https://www.darwinrecruitment.com/blog/2017/11/the-potential-of-behavioural-data-in-credit-scoring

The above data used on the basis of the non-financial transactions/usage provides very useful insight to decide on the most crucial outcome of credit scoring; should the credit be extended or not. It can be even more useful if it is complimented with financial data. The combined effect of the two is sure going to change the way credits are offered, very soon. And we can conclude saying that “All data is credit data”.

Comments :