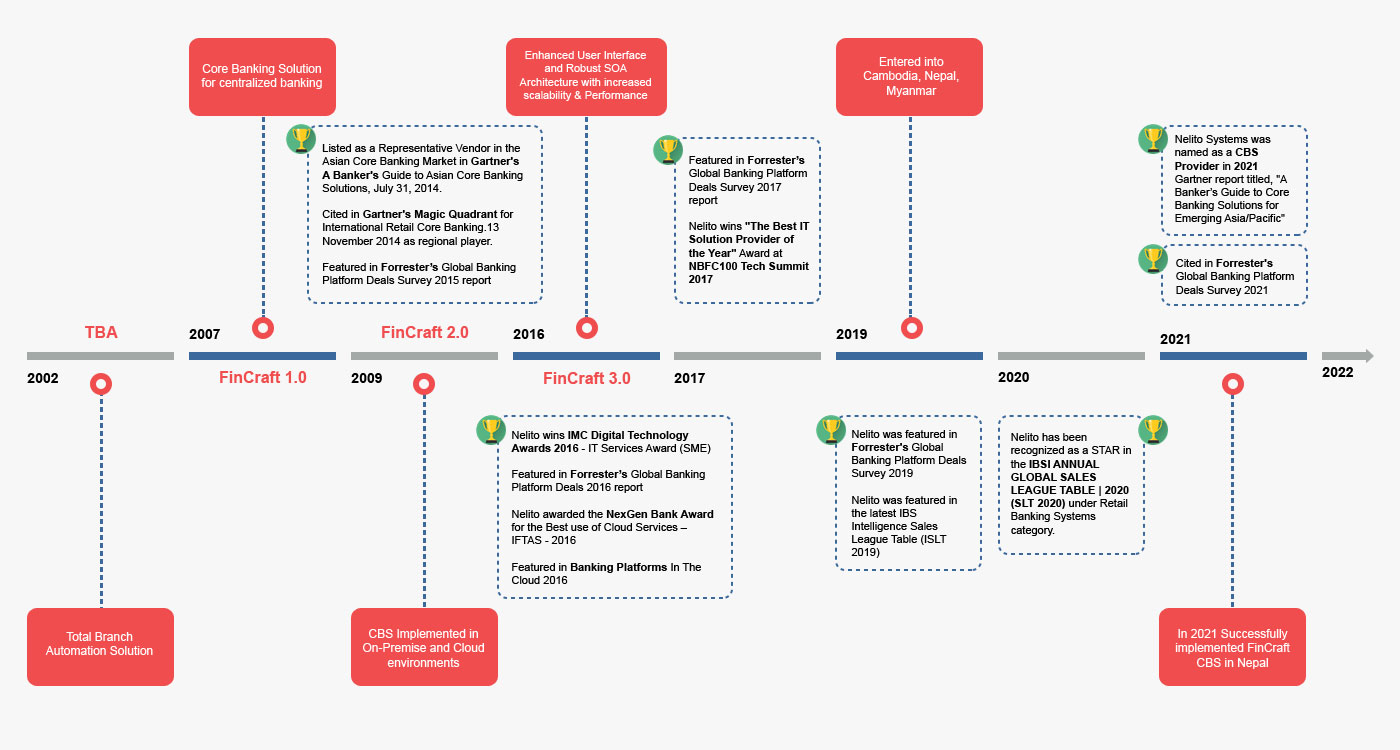

Core Banking Solution for centralized Banking

Enhanced User Interface and Robust SOA Architecture with increased scalability & Performance

Entered into Cambodia, Nepal, Myanmar

Listed as a Representation Vendor in the Asian Core Banking Market in Granter's A Banker's Guide to Asian Core Banking Solution, July 31, 2014

Cited in Granter's Magic Quadrant for International Retail Core Banking 13 November 2014 as regional player.

Featured in Forrester's Global Banking Platform Deals Survey 2015 report

Featured in Forrester's Global Banking Platform Deals Survey 2017 report

Nelito wins "The Best IT Solution Provider of the Year" Award at NBFC100 Tech Summit 2017

Nelito System was named as a CBS Provider in 2021 Gartner report titled, "A Banker's Guide to Core Banking Solution for Emerging Asia/Pacific"

Cited in Forrester's Global Banking Platform Deals Survey 2021

Nelito wins IMC Digital Technology Awards 2016 - IT Services Award (SME)

Featured in Forrester's Global Banking Platform Deals 2016 report

Nelito awarded the NexGen Bank Award for the Best use of Cloud Services - IFTAS - 2016

Featured in Banking Platforms in the Cloud 2016

Nelito was featured in Forrester's Global Banking Platform Deals Survey 2019

Nelito was featured in the latest IBS Intelligence Sales League Table (ISLT 2019)

Nelito has been recognized as a STAR in the IBSI ANNUAL GLOBAL SALES LEAGUE TABLE | 2020 (SLT 2020) under Retail Banking System category.

Total Branch Automation Solution

CBS implemented in On-Premise and Cloud environments

In 2021 Successfully implemented FinCraft CBS in Nepal.