What are JLG (Joint Liability Groups)?

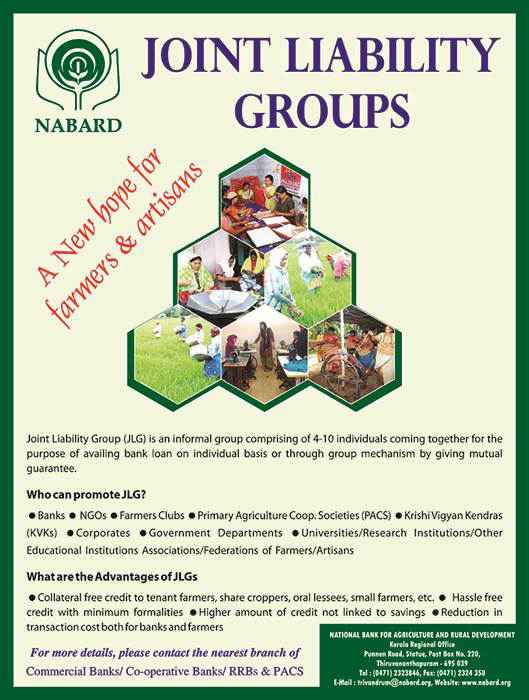

Updated On : June 2016 | by Amol S. KhanvilkarWith an aim to provide institutional loans to small farmers NABARD (National Bank for Agriculture and Rural Development) came up with the concept of Joint Liability Groups (JLG).

This is on a similar pattern of SHG (Self Help Groups) where NABARD provides refinance facility to banks for providing loans to small and marginal farmers. JLG schemes have proved very successful in North India especially UP, MP and Haryana.

NABARD has already 41 lakh SHGs which are credit linked.

Who can form JLG?

JLG consists of an informal group of 4 – 10 individuals (max 20) who are engaged in similar business/ occupation, formed with the purpose of availing loan through the group mechanism against mutual guarantee. JLG’s are usually formed by:

- Farmers Associations, Panchayat Raj Institutions (PRIs), Farmers' Clubs, Krishi Vikas Kendras (KVKs), State Agriculture Universities (SAUs), Business Facilitators, NGOs, Agriculture Technology Management Agency (ATMA), Bank branches, PACS, Other Co-operatives, Government Departments, Individuals, Input dealers, MFIs / MFOs etc.

About 400 JLGs had been floated in the Thuraiyur belt with a credit flow totalling Rs. 8 crore. “Not even a single case of overdue has been reported among the JLGs,” says NABARD official – The Hindu.

Models of JLG

A. Financing Individuals in the Group:

Size: 4-10 individual’s

The group is eligible for accessing separate individual loans from the financing bank. In such an arrangement each group member is jointly and severally liable for repayment of all loans taken by all individuals in the group).

B. Financing the Group:

Size: preferably of 4 to 10 individuals (may go up to 20)

This JLG functions as one borrowing unit. It is eligible for accessing one loan, which could be combined credit requirement of all its members.

Credit Assessment

Model A

A simple loan application is submitted by the JLG to the bank. The individual members of JLG become eligible for bank loan after the bank verifies the individual members’ credentials.

Model B

JLGs that undertake savings apart from credit are required to maintain books of accounts. They may also be graded by banks on the basis of performance parameters. However, the quantum of credit need not be linked to groups' savings as in the case of SHGs. The credit requirements for the group may be worked out based on combined credit plan needs of individual members.

Loan limit

Since loans are granted against the mutual guarantee offered by the group, maximum amount of loan is usually restricted to Rs. 50,000 per individual both under both the models.

Comments :