Nelito's Data Quality Solution

Updated On : June 2016 | by Amol S. KhanvilkarPublic sector banks today have grown tremendously in terms of territorial reach and are much ahead of their private sector counterparts in terms of reach in semi urban and rural parts of India. In terms of user accounts and transactions PSB's are in an enviable position.

In the coming future, this shall help PSB's to take on oversee newer initiatives and come out with products that will help masses to get the best banking services in the world.

This market positioning though also brings with itself its own set of problems which PSB's have begun to face now. These problems are related to the burgeoning amount of data owing to large no. of customers, their ever-increasing transactions, increasing competition, globalization, partners and frequent mergers/acquisitions which result in their consolidations.

Not only the prices and margins were driven down due to ever increasing competition, but the ever-growing number and scope of regulatory requirements like anti-terrorist, anti-money laundering, risk management and others have increased the burden on administrative, operational and IT resources driving up the total costs.

The need of the hour is that the PSB's must improve the efficiency of operations and take the needed initiatives by improving their marketing & customer relationship management strategies.

The critical factor in achieving both these objectives is to improve Data Governance & Data Stewardship Programs, Enterprise Data Architecture Programs, Meta-Data Programs, Business Intelligence Program which in turn help achieve high quality, efficiently managed data.

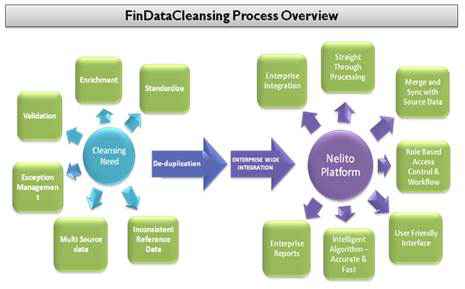

Nelito's Data Cleansing solution offers an integrated, enterprise scale, robust platform for Data Stewards/Custodians to perform full breath of data management services including Data Profiling, Standardization, Correction, Enrichment, Transformation, De-duplication, Encryption, Masking and Integrated Exception Management.

Nelito's Data Cleansing platform is proprietary innovative and first-in-industry data cleansing and mining web based enterprise scale solution. Data Cleansing supports seamless data source integration, automatic data extraction, cleansing, match & merge, cluster analytics, archival management from virtually any cluster of enterprise system. It builds its big data information extraction & analysis capability by leveraging Apache's Hadoop.

It adheres to SaaS Level 3 (on a scale of 0 to 3) Maturity where multiple Business Process are hosted on a single instance, deployed on a load-balanced farm of servers, with each Business Process data being kept in isolation.

Benefits of Nelito's Data Cleansing :

-

Single View of the Customer

-

- Removes duplicates and create a single view of the customer which gives an organization the ability it gives to analyse the customer behaviour in order to better target and personalize future customer interaction.

- It helps organizations to engage with customers through multiple channels, since customers expect those interactions to reflect a consistent understanding of their history and preferences.

-

Fraud Prevention

-

- Validates and matches KYC data with foreign black lists (lists issued by RBI, US/UK etc regulators) and identifies the suspected individuals which results in fraud/money laundering prevention.

- Help the bank comply with local and international regulations like SEBI, RBI, SEC, FRB, BSA, FinCEN, FATF, FSA, JMLSG, and MiFID.

-

Business Analytics

-

- Create House holding information within the bank which immensely helps bank's marketing programs target people at many levels - as an individual, as head of household or as a member of a given group of people (i.e., club, residence and/or business).

- Bank can identify behaviour patterns based on age or geography or income or household size.

-

Operational Excellence

-

- Eliminate on manual processes, minimizing risk of error.

- Reducing costs.

- Freeing staff from routine data analysis, redeploying into higher-value activities.

-

Risk Mitigation

-

- Greater Financial Control on the data.

- Standardization of methodologies around the enterprise.

- Able to set risk thresholds, data access and other controls centrally.

- Better compliance with regulatory requirements.

-

Performance

-

- Faster Processing– a million transactions data processed in 2.39 minutes (as tested by HP)

- Intelligent cleansing Engine to detect and report focused violations.

-

Fast Implementation

-

- Enterprise Solution, seamless integration with virtually any Upstream & Downstream Systems

- Highly flexible and Customizable via Configuration

- Customer Specific Customization via Configuration for any data structure, business rules and reporting.

Comments :