Internet Banking

Updated On : November 2015 | by Amol S. KhanvilkarThe innovations of information technology and internet have opened the new horizons to the Banking service delivery to the customers. Banking services are available on the finger tips of the customer via Internet Banking. Internet Banking, Net Banking or online banking allows you to perform various financial and non-financial transactions in your account with a click of button without visiting branch or ATM. It offers you a whole lot of features that earlier available only with the branch

In today’s fast-paced life, you need on-demand banking solutions for a better lifestyle. Internet Banking service gives you complete control over fund in your accounts online. Say bid-adieu to long queues and tired teller counter clerk. Now do banking from the comfort of your home or office, vacations ANYWHERE and ANYTIME!

Internet banking allows banking user to get connected to it’s bank’s internet banking portal to perform desire banking functions. If you are a Bank customer then you can avail Internet Banking facility after having received secure access of your net banking account from your bank. After secure login you will have direct access to your account. All the banking functions, financial and non-financials, that bank has made available on the internet banking mode will be displayed in menu of your online user account. You can select to perform any transaction and further result will be as per the policy for the nature of the service.

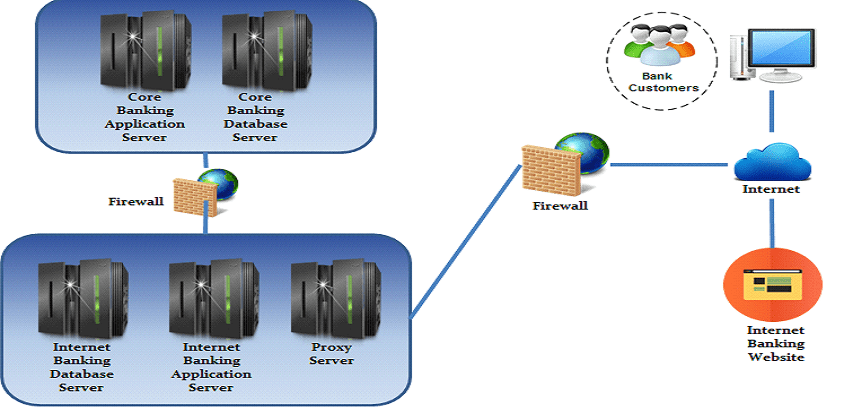

Your internet banking works on the concept of data centralization in the core banking system and allowing restricted access through net banking channel.

You must be apprehensive about the safety and security of online banking. Nelito’s Internet Banking product has following features to make your banking safe and secure:

- Internet Banking product is developed on SSL protocol and 128-bit encryption technology to provide a secure channel for data exchange – which keeps your online banking data secure and safe.

- Customer login is also verified at 2 levels by userid-password combination and PAN Number or Date of Birth authentications.

- 2 Factor Authentication (2FA) requires you to input OTP (One Time Password) sent only on to your registered mobile number for all key transactions.

- Your login session gets expired after a certain period in case there is no activity in your logged in session. This secures any unauthorized access to your logged in session.

- Tracking of wrong OTP and passwork attempts.

Thus your Netbanking is safe, fast and secure, enabling you to perform your banking transaction with total peace of mind .

Range of services and features on internet banking includes:

- Account Balance of all accounts linked to your customer ID

- View and Download account statement.

- Fund transfer through NEFT & RTGS

- Avail Different Deposit Schemes and Banking Services like insurance, credit cards, demand draft etc.

- Cheque Status and Stop Payment Request

- Pay government taxes

- Pay online your utility bills like Electricity, Telephone, Subscription payments along with Charity and Donation.

- Recharge your mobile/DTH connection.

- 24 x 7 Money Transfer through IMPS

- Set up standing instructions for transfer of fixed amount to be executed at fixed intervals.

- Various non-financial transactions like cheque book request, profile change, KYC, inquiries etc.

The scope of Internet Banking is increasing day by day. This is benefitting customer and as well as Banks to cut down the operation cost. Bank administrative module of internet banking helps bank to design and control the internet banking as per the business, regulation and operation requirements.

Nelito has Internet Banking product which is capable to be integrated with any Core Banking System and help Banks to meet the customer satisfaction with the power of internet banking.

Comments :